在加拿大

想分享一篇文章,呃才办?原?家?咀?有??板?啊 如果有?政治???版那?多好啊!呵呵。呃一篇就办在理?版吧,

评论

See to it that no one misses the grace of God. -- Hebrews 12:15想分享一篇文章,呃才办?原?家?咀?有??板?啊 如果有?政治???版那?多好啊!呵呵。点击展开...文章?铨:2012年诺贝尔奖“老战士”为什么获得诺贝尔经济学奖 作者: 王则柯 ?源:《南方咛末》2012-10-19 09:55:37 标签诺贝尔经济学奖博弈论现代经济学 编者按:[FONT=楷体, 楷体_GB2312, STKaiti]北 京时间2012年10月15日19点,瑞典皇家科学院诺贝尔奖评审委员会宣布,美国经济学家、哈佛大学教授埃尔文・罗斯(Alvin Roth)和加州大学洛杉矶分校教授罗伊德・沙普利(Lloyd Shapley)因为稳定配置和市场设计实践理论获得2012年诺贝尔经济学奖。这已经是诺奖第六次颁发给博弈论及相关信息经济学学者。[/FONT] [FONT=楷体, 楷体_GB2312, STKaiti]为 了深入了解两位诺奖得主的理论贡献与人生故事,我们邀请了三位中国经济学者来谈论他们眼中的罗斯和沙普利,以及博弈论对现代经济学的影响。他们分别是中山 大学岭南学院国际商务系教授、硕士生及博士生导师王则柯,北京大学国家发展研究院常务副院长巫和懋和复旦大学中国经济研究中心主任、博士生导师张军。[/FONT]

评论

See to it that no one misses the grace of God. -- Hebrews 12:15回复: RT2012年诺贝尔奖“老战士”为什么获得诺贝尔经济学奖听到沙普利获得诺贝尔经济学奖的消息,我很是激动了一下。 在此之前,已经有媒体邀请我在15日傍晚第一时间讲评年度诺贝尔经济学奖,我觉得难当此任。现在听到沙普利这非常熟悉的名字,我却感到有话要说了, 这不仅因为沙普利教授曾经是诺贝尔奖评选委员会忍痛割爱的学者,更因为他在哈佛大学本科学习期间,从军来到国统区,与中国军民并肩抗日,还因为破译密码立 功受奖,是与中国人民休戚与共的一位老战士。

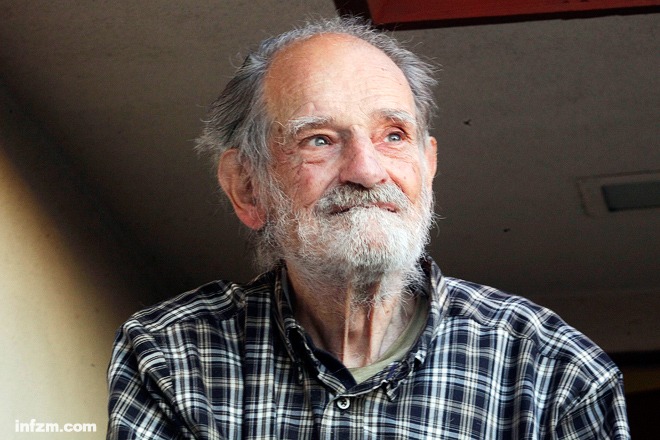

罗伊德・沙普利。 (南方周末资料图/图)

罗伊德・沙普利。 (南方周末资料图/图)评论

See to it that no one misses the grace of God. -- Hebrews 12:15回复: RT2012年诺贝尔奖“老战士”为什么获得诺贝尔经济学奖博弈论改写了现代经济学 现代经济学在20世纪经历了两次升华。一次是20世纪开初把微分学概念和方法引进经济学的“边际分析革命”,从此经济学变得不再乏味;另外一次,就是20世纪下半叶的“博弈论革命”――除了本身的成果以外,博弈论还在思想路线上改写了整个现代经济学。 诺贝尔经济学奖在1994年度授予三位博弈论专家哈萨尼(John Harsanyi)、纳什(John Nash Jr.)和泽尔滕(Reinhard Selten);在2005年度授予两位博弈论专家奥曼(Robert Aumann)与谢林(Thomas Schelling);在1996年度授予同样是研究博弈论和信息经济学的专家莫里斯(James Mirreles)和维克利(William Vickrey)。 在2001年度授予阿克洛夫(George Akerlof)、斯彭思(Michael Spence)和斯蒂格利茨(Joseph Stiglitz);在2007年度授予赫尔维茨(Leonid Hurwicz)、马斯金(Eric Maskin)和迈尔逊(Roger Myerson),后面六位都专于与博弈论关联紧密的信息经济学。 18年来,经济学奖6次授予博弈论的大师和与博弈论关系最密切的信息经济学的大师,可见博弈论与信息经济学在现代经济学主流发展中的位置。 至于此次获奖的沙普利,在二战结束后就返回哈佛校园继续他的学业。取得数学学士学位以后,他先在美国著名的“战略思想库”兰德公司工作了一年,随后 进入普林斯顿大学数学系,在塔克(A.W.Tucker)教授的指导下取得博士学位,塔克也是纳什的博士生导师。这样,塔克教授已经有两名学生获得了诺贝 尔经济学奖。

埃尔文・罗斯。 (南方周末资料图/图)

埃尔文・罗斯。 (南方周末资料图/图)评论

See to it that no one misses the grace of God. -- Hebrews 12:15回复: RT2012年诺贝尔奖“老战士”为什么获得诺贝尔经济学奖“沙普利值”与“权力指数” 在普林斯顿,沙普利被公认为博弈论奠基人冯诺意曼(John von Neumann)和摩根斯滕(Oskar Morgenstern)的传人,是合作博弈领域无可争议的领导者,在这个领域做出了许多贡献,包括比较容易学习的沙普利值(Shapley Value)。为略略说明沙普利值,我们举一个例子。假定某议会一共有100个议席,议员分属4个党派:红党43席,蓝党33席,绿党16席,白党8席;假定对于 一般议题的任何提案,议会实行一人一票并且多数通过的投票规则。又假设由于党纪的约束,议员对于任何议题都要按照党的意志投票。 现在我们计算4个党派在议会的“权力指数”,即在不同情况他加入或者退出一个投票联盟足以改变投票结果的可能性是多少。先看红党,他有43席,他可能面对的是7种情况,分别为蓝绿白联盟57票、蓝绿联盟49票、蓝白联盟41票、绿白联盟24和单独的蓝党33票、单独 的绿党16票和单独的白党8票。在这7种情况下,有6种情况他加入联盟会获胜,不加入联盟就失败,我们就说红党的权力指数是6。 再看蓝党,他有33席,他也面对7种情况,分别为红绿白联盟67票、红绿联盟59票、红白联盟51票、绿白联盟24票和单独的红党43票、单独的绿 党16票和单独的白党8票。在这7种情况下,他只有面对绿白联盟24票或者单独的红党43票这2种情况,才是决定议案是否通过的党团,从而蓝党的权力指数 是2。运用同样的方法,可以知道绿党的权力指数是2,白党的权力指数也是2。 你看,在这个议会里面,议员数目33的蓝党,与议员数目差不多只有他三分之一的白党,权力指数竟然一样,都是2。这就告诉我们,操纵一项提案是否能 够通过的“能力”,与议员党团成员数目并不成正比。4党的议员数目之比是43∶33∶16∶8,而“权力指数”之比却是6∶2∶2∶2。 沙普利值就是在分析这类问题时建立的概念和有力的工具。更加浅白一点的应用,是加装电梯的成本如何在不同楼层的公寓之间分摊,同一路线上远近不同的同事长期固定合伙乘出租车上下班如何分摊车费等等。 罗斯的贡献,特别体现在从抽象的理论到市场制度的实际设计的发展,考虑如何匹配不同的市场主体,例如学生如何与学校匹配,人体器官的捐献者如何与需要器官移植的患者匹配。有关的介绍已经很多,准确地把握则还是要研读严肃的论著,这里就不再展开了。

评论

See to it that no one misses the grace of God. -- Hebrews 12:15回复: RT2012年诺贝尔奖“老战士”为什么获得诺贝尔经济学奖博弈论在华人经济学界发育不够好 每次诺贝尔经济学奖公布之前,我们这里都有人热心地跑出来预测一番,不过猜对的情况总是比较少。这次经济学诺奖公布以后,一位财经评论者公开评论说 “今年的经济学诺奖纯属进入歪门邪道领域”。这位评论者谈到的其他理论是不是比“配对理论”重要,自然见仁见智,不过把博弈论的一些理论和方法概括为歪门 邪道、奇技淫巧,恐怕是太过分了。 我另外愿意提供的一点观察,就是整个华人经济学界在世界主流经济学的地位,近年来有下降的迹象,更不用说国内那些光环学者了。重要原因之一,就是博弈论这条腿发育得不够好。虽然有些学者正在努力,不过就总体而言,我们还是比较后进。 也正是基于这个观察,我作为一个经济学教师,在十多年前开始,就不自量力,对于曾经在经济学方面做出卓越贡献的经济学家贬斥博弈论几十年发展的文字和讲演,鲜明地提出商榷,取得一些效果。我还力所能及地做过一些普及博弈论的工作。 借此机会,我想顺便与大家探讨一下英文经济学术语Value的意思。除了经济学诺贝尔奖获得者德布鲁的名著《价值理论:经济均衡的一种公理化分析》 (The Theory of Value: An axiomatic analysis of economic equilibrium)以外,现代经济学文献很少使用Value这个词,更没有对应于中文“价值”二字的意义那样来使用Value,因为在中文里面, “价值”的说法已经被神圣化了。事实上,在德布鲁的《价值理论》中,他使用的Value,也只是一堆商品值多少钱这样相当形而下的一个名词。这次介绍年度 获奖者的各种中文资料里面,术语“沙普利价值”和书名《n人博弈的价值》的翻译,都不妥当,应该就是“沙普利值”和《n人博弈的值》,不应该用“价值”。 在没有把握的时候,翻译、介绍经济学进展的时候,尽量避免出现中文“价值”这样的词语,比较稳妥。 德国大文豪歌德在《浮士德》里面说:“一切理论都是灰色的,唯生命之树常青。”邹恒甫教授反其意而行之,提出(大意):“生命是短暂的,而理论之树常青。”沙普利比罗斯年长二十多岁,马上就是九旬老人了。幸亏他足够长寿,不然的话,我就要送给他“理论之树常青”这句话。 ([FONT=楷体, 楷体_GB2312, STKaiti]作者为中山大学岭南学院经济学系教授,硕士生及博士生导师[/FONT])

评论

See to it that no one misses the grace of God. -- Hebrews 12:15回复: RT2012年诺贝尔奖“老战士”为什么获得诺贝尔经济学奖Understanding economics: Priceless From The Economist, Oct 18th 2012, 19:49 by G.I. | WASHINGTON WHAT is economics concerned with? A layman taking in the raging debates over financial stability, inflation, economic growth, and budget deficits, would say it’s about money. That, of course, is not right. Money matters only insofar as it is a proxy for welfare. Money is a handy way of denominating prices and economists love prices because they are so efficient at allocating supply and demand so as to maximise welfare. Yet markets do not have to have money or prices to serve that welfare-maximising function. That distinction lies at the heart of the work that won this year’s Nobel Prize in economics, the subject of this week’s Free Exchange column.Lloyd Shapley of UCLA and Alvin Roth of Stanford University got the prize for studying the barriers to welfare maximisation in markets without prices: examples including matching college applicants to colleges, kidney donors to recipients, and even husbands to wives. Mr Shapley and David Gale (now deceased) devised an algorithm 50 years ago that would maximise the satisfaction of such multi-sided matching games. Read the column to learn more about how the theory works and its applications. I want to focus here on a more philosophical implication of their work.Mr Gale’s and Mr Shapley’s seminal 1962 paper was somewhat whimsical. Imagine a man, John, in love with a woman, Mary, but Mary is married to someone else. So John marries someone else as well. What if a year later he discovers Mary really does love him? Odds are they will find a way to be together, but it may involve infidelity, divorce and scandal (Prince Charles and Camilla can relate). On the other hand, if Mary really loves her husband more than John, both marriages will endure. Mr Gale and Mr Shapley devised an algorithm that would match partners in a way to minimise the number of unstable marriages and maximise the number of stable ones.Mr Gale and Mr Shapley acknowledged that their marriage-matching algorithm had “entered the world of mathematical make believe.” But they went on to make a larger point:Our result provides a handy counterexample to some of the stereotypes which nonmathematicians believe mathematics to be concerned with. Most mathematicians at one time or another have probably found themselves in the position of trying to refute the notion that they are people with ‘a head for figures’ or that they ‘know a lot of formulas’. At such times it may be convenient to have an illustration at hand to show that mathematics need not be concerned with figures … [our theorem] is carried out not in mathematical symbols but in ordinary English; there are no obscure or technical terms. Knowledge of calculus is not presupposed. In fact, one hardly needs to know how to count. Yet any mathematician will immediately recognize the argument as mathematical, while people without mathematical training will probably find difficulty in following the argument, though not because of unfamiliarity with the subject matter. What, then to raise the old question, is mathematics? The answer, it appears, is that any argument which is carried out with sufficient precision is mathematical, and the reason that your friends and ours cannot understand mathematics is not because they have no head for figures, but because they are unable to achieve the degree of concentration required to follow a moderately involved sequence of inferences.In a similar way, Mr Shapley's and Mr Roth's Nobel prize illustrates a larger point about economics. Undergraduates often study “utility functions” to learn how people choose alternative consumption baskets in a way that makes them better off. Once they go on to graduate school and then a job, they deal almost exclusively with priced transactions: for wheat, autos or equities.Yet in countless private and public policy questions, welfare can be improved in ways that do not show up in the price. Mr Roth’s work on public school admissions and kidney donations are an obvious example, but there are countless others. I recall reading that Starbucks had a plan that would let an employee in one store trade jobs with an employee in another so that both could work closer to home. The result would not change either employee’s output or wages, or Starbucks’ profits. Conceivably GDP would fall because the employees would spend less on petrol or bus fare. But provided the swap was voluntary, the welfare of both would without question rise.During election season, presidential candidates invariably defend their policies in terms of dollars or jobs: Barack Obama’s health care plan will save a family so much on insurance; his green energy investments will create so many jobs. Mitt Romney’s voucher plan will reduce Medicare’s costs. Yet some of the greatest welfare impacts of these policies can’t be priced. Obamacare eliminates much of the anxiety that hangs over every uninsured worker who worries about a financially crippling disease or injury. That surely must raise welfare. The energy efficiency standards imposed on makers of automobiles, appliances, toilets and light bulbs may save consumers’ money, but deprive them of choice: if you want a faster but less efficient dishwasher, you can’t buy one anymore. That is a loss of welfare that is not incorporated in regulators’ cost-benefit analysis. Nick Rowe once beautifully illustrated the flaw in the theory that public works projects, no matter how useless (such as digging holes and filling them in) were an effective form of stimulus in a liqudity trap. Truly useless projects may raise GDP, he noted, but they did not raise welfare, so the government may as well just hand the cash over to the workers.Contrary to the claims of Mr Romney and Paul Ryan, vouchers won’t solve Medicare’s long-term cost problem. Experience suggests the introduction of competition has only a transitory impact on health cost growth. Yet vouchers offer Medicare beneficiaries something they don’t have now: choice. By letting them allocate their Medicare dollars to an insurance plan that better suits their idiosyncratic preferences, they can achieve a higher welfare than if the same money were spent on the same plan everyone gets. (Note that proviso: the same money. If the voucher is worth less than the money they would have otherwise spent, the impact on welfare is ambiguous.) The value of that choice is not easily quantified, but it is real. It may not be obvious to presidential candidates, but that's why we have economists.

·加拿大新闻 看到快买加国Costco新晋爆款刷屏

·加拿大新闻 从追面子到享自我,宝马购车观转变

·加拿大新闻 每周连轴转80小时加拿大医生自爆行业黑幕

·加拿大新闻 万锦、Newmarket多家奶茶店/美甲店/理发店被指控+开罚单

·加拿大新闻 移民急刹车见效!加拿大人口首次出现历史性大幅下降

·中文新闻 一名男子因推动反犹太复国主义而在悉尼市议会市长的长篇大论

·园艺 蒜黄和蒜芽