加拿大华人论坛 加拿大房产Condo把一批炒房人害惨了

在加拿大

Toronto real estate: Condo buyers ‘scrambling' to close dealsMortgage brokers, realtors and developers have seen a surge the last few months in people who bought pre-construction condos two to three years ago “scrambling” to get financing to close deals.Some have had to walk away from deposits worth tens of thousands of dollars. Others have been forced to borrow from family — or against their principal residence — to come up with final payments on condos that lenders are no longer keen to finance, according to interviews with a number of players in Toronto’s condo industry.Hardest hit have been the self-employed who had pre-approvals from lenders when they bought their pre-construction units. But now, with the unit almost complete and final payments due, they are being told they need 35 to 50 per cent down, instead of just 20 per cent of the purchase price, unless they want to rely on secondary lenders offering rates that can hit double digits.Many investors who bought units intending to flip them on completion, or rent them out for a few years, have also been shocked to find they thought they had pre-approvals, but they are no longer being honoured in the wake of tighter lending rules imposed by Ottawa.Toronto real estate lawyer Oksana Miroutenko has had two cases in the last few months where clients took interim occupancy of their new condos, only to find out weeks later, when final payments were due, that they couldn’t meet new, more stringent, financing conditions.One worked contract jobs that didn’t bring in a steady enough income to satisfy lenders. Another, who forfeited $35,000 in deposits, became pregnant and her husband lost his job after they’d purchased and been preapproved, says Miroutenko.“This is the hardest environment I’ve seen for borrowing money in the last 10 years,” says Toronto realtor and condo developer Brad Lamb.He’s had about 800 condo units close in four of his projects over the last year and says just three people were unable to finalize deals.Another 15 or so sought permission to put their units up for sale on the so-called assignment market — in hopes of selling before final payments were due.“There were definitely people that were scrambling to close,” said Lamb. While some had taken on more debt than they could handle, the far bigger issue was thousands of dollars in HST and other closing costs, such as escalating municipal development fees, that buyers just hadn’t anticipated when they bought, he added.But even selling in the assignment market is proving to be much tougher than it was just over a year ago, when federal Finance Minister Jim Flaherty imposed tougher lending rules in an attempt to cool the temperatures in what was seen as overheated condo markets in Toronto and Vancouver.A unit that sold for, say, $300,000 two or three years ago may be worth about $350,000 today, but many lenders will only finance a new buyer for the original price, not the current market value, mortgage brokers are finding.That’s making it tougher for pre-construction buyers who run into financial problems to unload their units.Financial analyst and long-time housing watcher Ben Rabidoux believes these are just the first “cracks” in Toronto’s housing market and could worsen next year when a record number of new condos — estimates range from about 20,000 to almost 43,000 depending on construction bottlenecks — are expected to be completed.“An estimated 85 per cent of condo units under construction in Toronto have been sold, but they’ve not (all) been sold to end users, and buyers have not yet been financed,” Rabidoux says in a recent note to investor clients. “Therein lies the problem.”Mortgage broker Jake Abramowicz believes the saving grace, so far, is that condo buyers generally own principal properties, against which they can borrow to complete condo deals. As well, the Toronto rental market is extraordinarily strong, so condo buyers can generally cover their costs by renting units out.But he still shakes his head at the auditor who called him in a panic a few weeks ago, looking for a mortgage on a $680,000 condo.She’d put 20 per cent down on the investment unit but, with closing costs just about due, her bank now wanted 50 per cent down. That’s because she and her husband had stepped up their spending and their costs now exceeded 50 per cent of their gross income — far in excess of what’s allowed under the new lending guidelines.In the end, she borrowed the difference from a sister and close on the unit, which she now hopes to sell.

评论

回复: Condo把一批炒房人害惨了没觉得炒房的惨,倒是把租房的无房户害惨了

评论

回复: Condo把一批炒房人害惨了无房户没钱的也惨,有钱的倒是开心了。

评论

回复: Condo把一批炒房人害惨了开心

评论

回复: Condo把一批炒房人害惨了没觉得炒房的惨,倒是把租房的无房户害惨了点击展开...佩服你的解读能力!

评论

回复: Condo把一批炒房人害惨了大量入市,大量放租(很多是抛售不成后的选择),只能有利于租房的无房户。

评论

回复: Condo把一批炒房人害惨了佩服你的解读能力!点击展开...高登在房子的事情上,是典型的屁股决定脑袋论,一直以来都选择性失明的

评论

回复: Condo把一批炒房人害惨了高登在房子的事情上,是典型的屁股决定脑袋论,一直以来都选择性失明的点击展开...屁股决定脑袋,还是把脑袋埋在沙堆里,驼鸟战术?

评论

回复: Condo把一批炒房人害惨了有米的不妨等几年,等这批建设高峰的condo都快交楼的时候,哀鸿遍野的时候,再出手收拾残局。

评论

回复: Condo把一批炒房人害惨了屁股决定脑袋,还是把脑袋埋在沙堆里,驼鸟战术?点击展开...脑袋还在外面,高登对付小和尚的时候除了可以简单的用一只胳膊搞定,用脑子也是蛮清醒的

评论

回复: Condo把一批炒房人害惨了屁股决定脑袋,还是把脑袋埋在沙堆里,驼鸟战术?点击展开...I think Both

评论

回复: Condo把一批炒房人害惨了请讲一下白石工作好找吗

评论

回复: Condo把一批炒房人害惨了以前还行,这一两年买楼花的是倒楣了。

评论

回复: Condo把一批炒房人害惨了炒房的还有地方住

评论

回复: Condo把一批炒房人害惨了哈哈,看热闹,围观。

评论

Enjoy each and every day!回复: Condo把一批炒房人害惨了都是自己的选择,何来害不害一说?

评论

回复: Condo把一批炒房人害惨了有啥惨的房子不还在呢吗

评论

炒房的还有地方住点击展开...你这是强盗逻辑:"炒房的有地方住"和"投资失败"完全两码事。

评论

回复: Condo把一批炒房人害惨了你这是强盗逻辑:"炒房的有地方住"和"投资失败"完全两码事。点击展开...可以等到成功的到来

评论

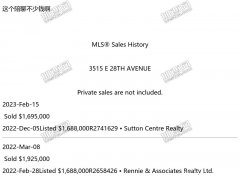

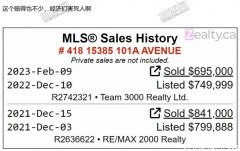

回复: Condo把一批炒房人害惨了这个论坛里喜欢谈投资的两个,一个是版主马龙,一个实gordon,其实都是投资上的失败者。版主马龙,炒condo炒成房东,如果他当初投资独立屋,情况就会大不同。邓公公,人在上海,却在温哥华买房。如果在上海买,赚的肯定多很多。

·加拿大新闻 发现了吗?房贷才是检验牛马的唯一标准

·加拿大新闻 全新奥迪A6L3.0T:2026年上市,外观变化太大?

·加拿大新闻 幕后牵线曝光!万锦自由党议员出手,促成马荣铮跳槽

·加拿大新闻 加拿大大部分地区将迎“白色圣诞”安省魁省概率最高

·加拿大新闻 [评论] 保守党频出状况博励治领导地位岌岌可危

·生活百科 这算不算车道?

·中文新闻 悉尼女子与兄弟争夺继承权后挪用100万澳元